Table of Contents

The need for secure and efficient payment handling has never been more critical. Whether you’re a small startup or a growing enterprise, providing your customers with fast, reliable payment options can make or break your success. But speed alone isn’t enough—ensuring security and seamless transactions is just as important.

In this post, we’ll dive into eight essential tools and strategies every business needs to streamline payment processing while safeguarding sensitive data. From the right payment gateways to encryption protocols, these key components will help you offer an exceptional customer experience and stay ahead of the competition.

Let’s explore how you can ensure smooth, secure transactions that benefit both your business and your customers.

Reliable Payment Gateways for Seamless Transactions

A payment gateway is essential for processing online transactions, enabling businesses to accept credit card payments and other forms of digital payments securely. Choosing a reliable payment gateway ensures your transactions are fast and secure, minimizing the risk of fraud or data breaches. Look for a gateway with a robust infrastructure that integrates easily with your website or point-of-sale system.

It should also support multiple payment methods, such as credit and debit cards, e-wallets, and even cryptocurrencies. For instance, you can find reliable merchant services for small businesses that prioritize ease of use, transaction speed, and high-level security. This helps provide customers with a smooth and convenient checkout experience.

End-to-End Encryption for Data Protection

Ensuring the security of customer information is a top priority in payment handling. End-to-end encryption protects sensitive data, like credit card details, by encoding it during transmission. This ensures that even if data is intercepted during the transaction process, it remains unreadable to unauthorized users.

It’s crucial to choose payment providers that offer high-level encryption standards, such as SSL (Secure Socket Layer) or TLS (Transport Layer Security). Implementing end-to-end encryption not only helps protect your customers but also builds trust, encouraging more frequent transactions.

Additionally, encryption ensures compliance with regulations like PCI-DSS (Payment Card Industry Data Security Standard), safeguarding your business from potential penalties and reputational damage.

Fraud Prevention Tools to Safeguard Your Business

Fraudulent transactions can cause significant financial and reputational damage to a business. To prevent such incidents, implementing robust fraud prevention tools is essential. These tools typically include features like real-time transaction monitoring, machine learning algorithms to detect unusual patterns, and multi-factor authentication (MFA). Fraud prevention systems are designed to identify potential fraud before it happens, allowing businesses to block or flag suspicious transactions.

You can find services for businesses looking to integrate advanced fraud detection capabilities, including address verification systems and card security code checks. These tools enhance transaction security and protect both businesses and customers from fraud-related risks.

Mobile Payment Solutions for On-the-Go Transactions

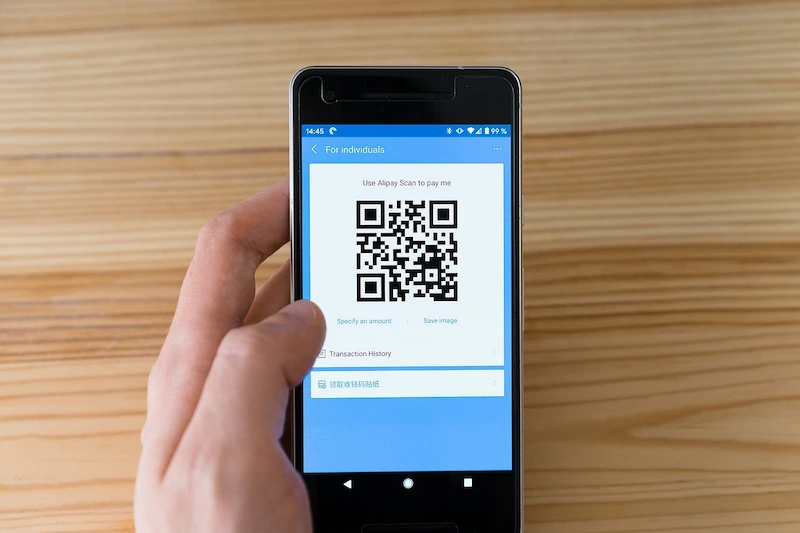

With the rise of mobile commerce, offering mobile payment options is a must for businesses that want to stay competitive. Mobile payment solutions, such as Apple Pay, Google Pay, and other mobile wallets, allow customers to complete transactions swiftly using their smartphones. These solutions are convenient, secure, and increasingly preferred by consumers. Implementing mobile payment options not only provides your customers with flexibility but also helps increase sales by offering fast checkout experiences.

When choosing a mobile payment solution, ensure it integrates seamlessly with your existing systems and provides secure tokenization methods to protect customer payment data. This approach will drive higher engagement and improve customer satisfaction.

Clear Payment Policies to Manage Customer Expectations

Clear payment policies are essential for managing customer expectations and ensuring smooth transactions. Businesses should define terms related to payment methods, timelines, refunds, and chargebacks. Having clear, transparent policies can help prevent misunderstandings, build trust with customers, and streamline the payment process. Consider including details on accepted payment types, invoice processing times, and any associated fees.

A well-defined policy also protects your business legally, offering clarity in case of disputes or chargebacks. When customers know what to expect, they’re more likely to complete their purchases and remain loyal. It’s also beneficial to make these policies easy to find on your website for added transparency.

Recurring Billing Features for Subscription-Based Models

For businesses that offer subscription-based services or products, recurring billing is a crucial feature to implement. This automated billing system helps businesses collect payments on a regular basis without requiring manual intervention for each transaction. Recurring billing solutions can be tailored to specific intervals, such as weekly, monthly, or yearly, and can handle varying amounts depending on the services used. With this system in place, businesses can improve cash flow and reduce the risk of missed payments.

Customers enjoy the convenience of not having to re-enter payment information each time. Choose a recurring billing system that integrates seamlessly with your payment gateway and provides secure handling of sensitive data.

Multi-Currency Payment Processing for Global Reach

As businesses expand their reach globally, the ability to accept multiple currencies is vital for ensuring seamless international transactions. Multi-currency payment processing allows businesses to handle payments in various currencies, ensuring that customers from different countries can make purchases in their preferred currency. This not only enhances the customer experience but also eliminates the complexities of conversion fees.

Businesses can also use multi-currency systems to reduce the chances of cart abandonment due to hidden charges or complex payment processes. When selecting a payment processor, look for one that offers competitive exchange rates, low international transaction fees, and the ability to support a wide range of currencies.

Comprehensive Reporting Tools for Payment Tracking

Effective payment handling is incomplete without comprehensive reporting tools that provide insights into your transactions. These tools allow businesses to track sales, monitor payment success rates, and identify trends, helping to optimize cash flow management. By analyzing payment data, businesses can gain a deeper understanding of their customer base, identify potential issues, and improve decision-making processes.

Reporting tools also help businesses stay compliant with financial regulations and prepare accurate financial statements for tax purposes. Choose a payment processing solution that offers detailed, customizable reports, enabling you to view and analyze your transaction history with ease. This feature adds transparency and efficiency to your payment handling system.

Fast and secure payment handling is essential for businesses to thrive in today’s competitive market. By implementing reliable payment gateways, robust encryption, fraud prevention tools, and mobile payment solutions, you can enhance customer experience while safeguarding sensitive data. Clear payment policies, recurring billing options, and multi-currency support will ensure smooth transactions across borders and business models. Additionally, comprehensive reporting tools provide valuable insights for better financial management. With these eight key components in place, businesses can streamline payment processes, foster customer trust, and ensure long-term success in an increasingly digital world.

Want to explore something different? 6 Ways to Heal Emotional Wounds and Improve Mental Health